Are you a woman struggling to make ends meet? Building an emergency fund can be a daunting task, but it’s a crucial step in achieving financial stability.

In this article, we’ll explore the importance of having an emergency fund for women, and provide practical tips on how to build one.

With the right strategies and mindset, you can create a financial safety net that will help you weather any financial storm.

Creating a Budget for Your Emergency Fund

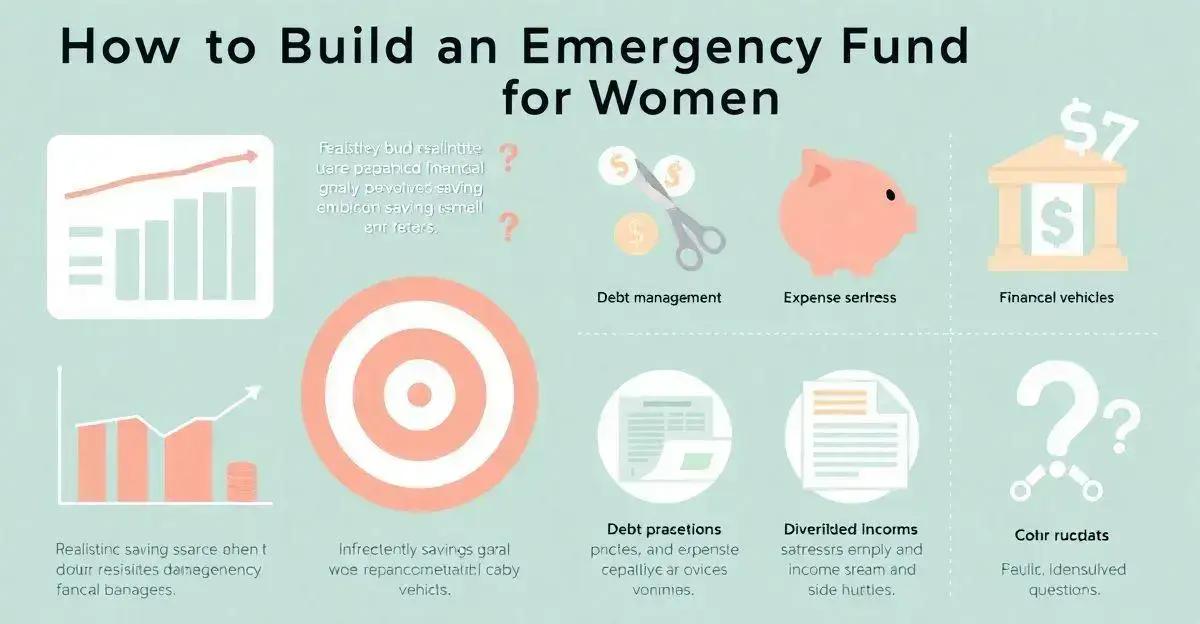

Before you start building your emergency fund, it’s essential to create a budget that outlines your financial priorities. Start by tracking your income and expenses to identify areas where you can cut back and allocate funds towards your emergency fund. Consider using the 50/30/20 rule as a guideline, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment. Once you have a clear picture of your financial situation, you can start setting realistic goals for your emergency fund.

Setting realistic goals for your emergency fund is crucial to achieving success. Start by identifying your short-term and long-term financial goals, such as paying off debt, building a down payment for a house, or covering unexpected expenses. Consider setting specific targets, such as saving $1,000 in the next six months or building a fund that covers three to six months of living expenses. Having clear goals will help you stay motivated and focused on your financial objectives.

When it comes to building your emergency fund, it’s essential to choose the right savings vehicle. Consider high-yield savings accounts, certificates of deposit (CDs), or money market accounts, which offer higher interest rates and fewer fees than traditional savings accounts. You can also consider a first-time savings account or a savings account with a low minimum balance requirement. It’s essential to research and compare different options to find the one that best fits your financial needs and goals.

Managing debt and reducing expenses are essential steps in building your emergency fund. Start by prioritizing your debts, focusing on high-interest debts first, and making more than the minimum payments. Consider consolidating debt into a single, lower-interest loan or credit card. To reduce expenses, cut back on discretionary spending, negotiate lower rates with service providers, and take advantage of employee benefits, such as flexible spending accounts or employee assistance programs.

Diversifying your income streams is a critical component of building your emergency fund. Consider starting a side hustle, such as freelancing, tutoring, or dog walking, to supplement your primary income. You can also take advantage of online gig economy platforms or rent out a spare room on Airbnb. Having multiple income streams will provide a financial safety net in case of unexpected expenses or job loss.

Here are some frequently asked questions about building an emergency fund for women:

- Q: How much should I save in my emergency fund?

- A: Aim to save three to six months’ worth of living expenses.

- Q: Should I prioritize paying off debt or building my emergency fund?

- A: Prioritize paying off high-interest debt, then focus on building your emergency fund.

- Q: How can I stick to my emergency fund goals?

- A: Set specific targets, track your progress, and review your budget regularly.

Setting Realistic Goals for Your Fund

Setting realistic goals for your emergency fund is crucial to achieving success. Aiming to save a specific amount within a certain timeframe can help you stay motivated and focused. For example, you can set a goal to save $1,000 in the next six months, or to build a fund that covers three to six months of living expenses. Having a clear plan in place will help you make progress towards your financial objectives, and avoid feeling overwhelmed by the task of building your emergency fund.

Choosing the Right Savings Vehicle

When selecting a savings vehicle for your emergency fund, it’s essential to consider the type of account that best fits your financial needs and goals. High-yield savings accounts, certificates of deposit (CDs), and money market accounts are popular options, offering higher interest rates and fewer fees than traditional savings accounts.

Consider the minimum balance requirements and fees associated with each account, as well as the interest rate and compounding frequency. Additionally, research and compare different options to find the one that suits your needs, such as online banks or credit unions, and take advantage of mobile banking apps for easy account management.

Managing Debt and Reducing Expenses

Managing debt and reducing expenses are crucial steps in building an emergency fund. Start by prioritizing your debts, focusing on high-interest debts first, and making more than the minimum payments.

Consider consolidating debt into a single, lower-interest loan or credit card, and take advantage of debt management programs or credit counseling services.

To reduce expenses, cut back on discretionary spending, negotiate lower rates with service providers, and take advantage of employee benefits, such as flexible spending accounts or employee assistance programs.

Automate your savings by setting up automatic transfers from your checking account to your emergency fund, and make sure to review and adjust your budget regularly to ensure you’re on track to meet your goals.

Diversifying Your Income Streams

Diversifying Your Income Streams is essential for financial stability and growth.

By exploring various avenues for income, individuals can mitigate risks associated with relying on a single source.

Strategies for Diversification

Consider investing in stocks, real estate, or starting a side business.

Each of these options can provide additional revenue and help build a more resilient financial portfolio.

Moreover, developing skills in different areas can open up new opportunities and enhance your earning potential.

Ultimately, the key to successful diversification is to assess your interests and resources, and to take calculated risks.

Building an Emergency Fund for Women: Frequently Asked Questions

Q: What is an emergency fund and why is it important for women?

A: An emergency fund is a savings account dedicated to covering unexpected expenses, such as car repairs, medical bills, or losing your job. It’s essential for women because it provides financial stability and peace of mind during uncertain times.

Q: How much should I save in my emergency fund?

A: Aim to save three to six months’ worth of living expenses, which can help you cover essential expenses if you experience a loss of income.

Q: Can I use my emergency fund for non-essential expenses?

A: No, it’s best to use your emergency fund only for unexpected expenses, not for discretionary spending. Consider setting aside a separate fund for non-essential expenses, such as entertainment or travel.

Frequently Asked Questions about Emergency Funds for Women

What is an emergency fund and why is it important for women?

An emergency fund is a savings account dedicated to covering unexpected expenses, such as car repairs, medical bills, or losing your job. It’s essential for women because it provides financial stability and peace of mind during uncertain times.

How much should I save in my emergency fund?

Aim to save three to six months’ worth of living expenses, which can help you cover essential expenses if you experience a loss of income.

Can I use my emergency fund for non-essential expenses?

No, it’s best to use your emergency fund only for unexpected expenses, not for discretionary spending. Consider setting aside a separate fund for non-essential expenses, such as entertainment or travel.

How can I create a budget for my emergency fund?

Start by tracking your income and expenses to identify areas where you can cut back and allocate funds towards your emergency fund. Consider using the 50/30/20 rule as a guideline, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

What are some tips for managing debt and reducing expenses?

Prioritize your debts, focusing on high-interest debts first, and make more than the minimum payments. Consider consolidating debt into a single, lower-interest loan or credit card, and take advantage of debt management programs or credit counseling services. To reduce expenses, cut back on discretionary spending, negotiate lower rates with service providers, and take advantage of employee benefits, such as flexible spending accounts or employee assistance programs.

How can I diversify my income streams?

Consider starting a side hustle, such as freelancing, tutoring, or dog walking, to supplement your primary income. You can also take advantage of online gig economy platforms or rent out a spare room on Airbnb. Having multiple income streams will provide a financial safety net in case of unexpected expenses or job loss.